How to Apply for the Monzo Flex Credit Card Step-by-Step Guide

Discover Financial Flexibility with Monzo Flex

Unlock a world of financial flexibility and ease with Monzo Flex, your companion for smarter spending in the UK. Whether you’re aiming to manage monthly expenses or finance larger purchases, this innovative credit card offers a seamless experience tailored specifically for your needs. Imagine the peace of mind that comes with knowing your finances have the flexibility to meet life’s demands.

The Benefits of Monzo Flex

With Monzo Flex, you can benefit from an array of features designed to put you in control:

- Flexible repayment options that let you spread the cost of purchases over manageable installments, ensuring you stay on top of your budget while maintaining your desired lifestyle.

- Instant decision-making through a straightforward application process, allowing you to access funds quickly and without hassle. This means more time enjoying life and less time worrying about financial arrangements.

- No hidden fees to surprise you, ensuring that you can plan and manage your budget with confidence and transparency. With Monzo Flex, what you see is truly what you get.

A Financial Future Powered by Responsible Actions

Embarking on this financial journey with Monzo Flex is simpler than you might think. By taking responsible actions today, you’re not just managing your finances—you’re building a secure and bright future. The thoughtful design of Monzo Flex is meant to align with your well-being, making it a reliable partner on your journey.

So why wait? Take the first step towards a more secured financial lifestyle. Monzo Flex is here to enrich your life, offering tools and insights to empower you to make well-informed decisions. Ready to explore how this remarkable card can transform your financial life for the better?

Unlocking the Benefits of the Monzo Flex Credit Card

1. Flexible Payment Options

The Monzo Flex Credit Card empowers you with flexibility, allowing you to spread the cost of purchases over three, six, or twelve months. This adaptability means you can align your payment plan with your financial situation and avoid the stress of hefty one-time payments.

Tip: To make the most of this benefit, plan your larger purchases around your budget. Spreading costs can help ease monthly finances without sacrificing essentials.

2. Interest-Free Period for Big Purchases

For those big-ticket items, the Monzo Flex Credit Card offers an interest-free period for transactions paid off within three months. This can be a game-changer for planned expenses, providing a breathing room to manage finances better.

Tip: Use this interest-free period strategically for essential expenses you were already saving for. This way, you can benefit from the flexibility, manage your cash flow, and not incur extra costs.

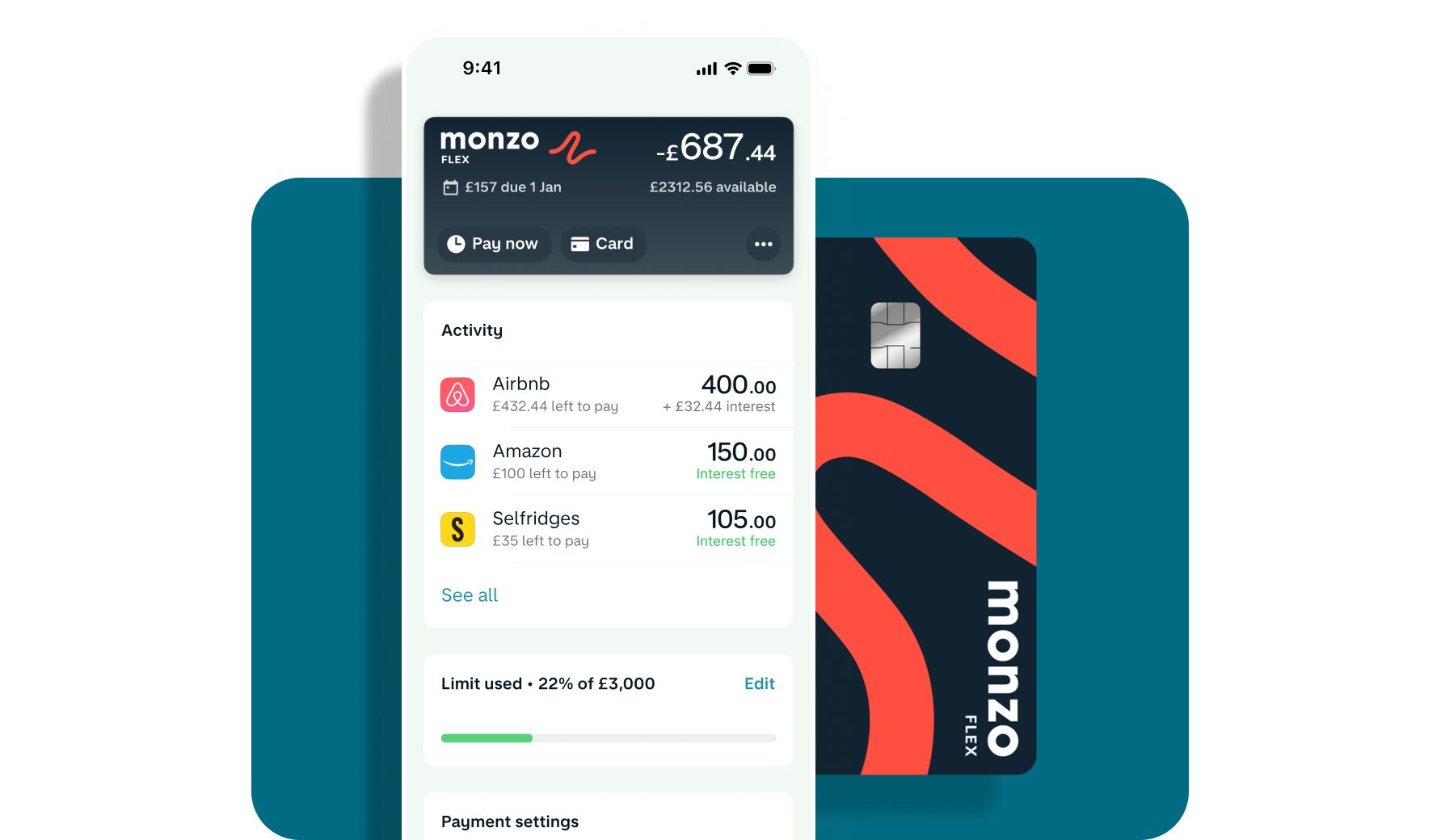

3. Convenient Integration with the Monzo App

With seamless integration into the Monzo app, you can effortlessly track your spending and manage your payments all in one place. This connectivity ensures you have total visibility over your finances, letting you stay on top of your budget and avoid unnecessary financial stress.

Tip: Regularly review your app insights and reports to identify spending trends. This can help you make more informed decisions about your financial habits and savings goals.

4. Building Your Credit Score

By using your Monzo Flex Credit Card responsibly, you have the opportunity to improve your credit score. Regularly paying off your credit card balance showcases your reliability to lenders, which can be invaluable when applying for larger loans in the future.

Tip: Set up automatic payments for at least the minimum due to never miss a payment. Consistent and timely payments bolster your creditworthiness, opening doors for better financial opportunities down the line.

SEE HOW TO GET YOUR MONZO FLEX CREDIT CARD

| Benefit | Key Features |

|---|---|

| Flexible Payments | Choose to pay back in installments, making budgeting easier. |

| No Hidden Fees | Transparent costs with no surprise charges, ensuring peace of mind. |

The Monzo Flex Credit Card empowers individuals with financial flexibility and a sense of control. With options to manage how you repay what you owe, you can navigate your expenses more effectively, avoiding the stress of tight budgets. The absence of hidden fees means that you can make informed decisions about your finances, knowing exactly what to expect without any unwelcome surprises.In addition to these advantages, the Monzo Flex Credit Card provides insights into spending habits, promoting responsible financial management. By utilizing notifications and tracking features through the Monzo app, users are encouraged to maintain their financial health while enjoying the freedom that a credit card can provide. Embrace a path to wiser spending with the Monzo Flex Credit Card, where your financial future is where you want it to be.

Requirements for Monzo Flex Credit Card

- To apply for the Monzo Flex Credit Card, it’s essential to be a resident of the United Kingdom. This ensures you can benefit from Monzo’s localized customer support and financial services.

- Aged 18 or over, applicants should have a strong sense of financial responsibility and maturity to make informed decisions about their credit usage.

- It’s critical to possess a minimum annual income of £12,000. A steady income reflects your ability to manage credit and make consistent repayments.

- Your credit score plays a vital role in the application process. A good credit score, generally above 650, significantly enhances your chances of approval and access to better terms.

- Finally, having a UK bank account is required. This facilitates easy and direct management of transactions through Monzo’s seamless integration and digital banking systems.

VISIT THE WEBSITE TO LEARN MORE

Your Guide to Applying for the Monzo Flex Credit Card

Step 1: Visit the Monzo Website or Access the Mobile App

To begin your journey towards flexible financing with the Monzo Flex Credit Card, your first step is to visit the Monzo website or open the Monzo mobile app. Here, you will find all the necessary information and a user-friendly interface designed to guide you through the application process. Ensure you have a stable internet connection to navigate smoothly through the website or app.

Step 2: Navigate to the Monzo Flex Credit Card Section

Once you have accessed Monzo’s platform, look for the section dedicated to the Monzo Flex Credit Card. You’ll typically find this under the “Products” or “Credit Cards” section. Click on it to reveal comprehensive details about the card’s features, benefits, and eligibility requirements. Understanding these will empower you to make the best decision for your financial needs.

Step 3: Review Terms and Conditions

Before committing to your application, it’s crucial to review the terms and conditions associated with the Monzo Flex Credit Card. Thoroughly reading these documents will give you insight into interest rates, repayment options, fees, and any other obligations. This step ensures that you are making a well-informed and conscious choice about your financial engagement.

Step 4: Start the Application

With clear information in hand, proceed to fill out the application form. You’ll need to provide personal information such as your name, address, contact details, and financial information. Ensure that all entries are accurate to avoid any delays in the approval process. This is your moment to step responsibly into the world of enhanced and flexible financial management.

Step 5: Await Approval

After submitting your application, the final step is to wait for approval. Monzo’s efficient system strives to provide timely responses. You’ll receive updates via your registered email or through notifications on the Monzo mobile app. Upon approval, your Monzo Flex Credit Card will be ready to help you manage expenses with flexibility and ease.

LEARN MORE DETAILS ABOUT MONZO FLEX CREDIT CARD

Frequently Asked Questions About Monzo Flex Credit Card

What is the Monzo Flex Credit Card, and how does it work?

The Monzo Flex Credit Card is an innovative credit solution designed to offer flexibility and convenience. It allows you to spread the cost of your purchases over a period of time that suits you—typically 3, 6, or 12 months. What’s inspiring about this card is that you have the power to control your repayments, enabling you to manage your finances responsibly while enjoying the things you love.

Who is eligible to apply for the Monzo Flex Credit Card?

Eligibility for the Monzo Flex Credit Card is open to residents of the United Kingdom who meet certain financial criteria. You must be at least 18 years old and hold an active Monzo account. Monzo reviews each application based on individual creditworthiness to ensure you can enjoy this financial tool without stress. It’s all about connecting you with the credit solutions that empower you.

Are there any fees or interest rates associated with the Monzo Flex Credit Card?

The Monzo Flex Credit Card offers transparency and simplicity. While specific terms may vary, the card typically features zero fees for spreading the costs over 3 months. For longer repayment periods, an interest rate may apply. It’s important to review the terms carefully and choose the repayment plan that fits your financial goals, allowing you to stay on top of your finances with confidence.

How can I apply for the Monzo Flex Credit Card?

Applying for the Monzo Flex Credit Card is a seamless process conducted through the Monzo app. If you already have a Monzo account, you can explore the Flex feature directly within the app. The application process is straightforward and designed to empower you quickly with the credit options you need. Embrace the opportunity to enhance your financial journey with ease and clarity.

What makes the Monzo Flex Credit Card different from traditional credit cards?

The Monzo Flex Credit Card stands out because it prioritizes flexibility and user control. Unlike traditional credit cards, it allows for tailored repayment plans without unexpected fees, giving you a clearer path to achieving financial well-being. It’s designed not just for making purchases, but for helping you nurture a healthier relationship with your finances, fostering a sense of financial freedom and responsibility.

Related posts:

How to Apply for the American Express Gold Credit Card Easily

How to Apply for Santander All in One Credit Card Easy Steps

How to Apply for a NatWest Reward Black Credit Card Today

How to Apply for a Barclaycard Avios Credit Card Step-by-Step Guide

How to Apply for the NatWest NatWest Credit Card Successfully

How to Apply for the American Express Cashback Credit Card Online

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the Fazendo Receitas platform. Her goal is to empower readers with practical advice and strategies for financial success.